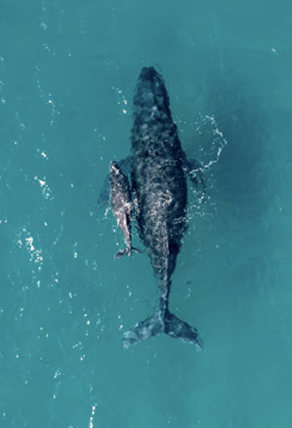

Taking climate action

We believe that climate change is a financially material risk, and that full consideration of climate-related risks and opportunities is both part of our fiduciary duty and a requisite for creating value for clients. We have committed to net zero by 2050, and have established interim short-term and medium-term targets to support our decarbonisation journey.

How we bring theory into practice

Our journey

How we do it

Our climate strategy

Progress towards our goals is driven by our Climate Change Strategy. It is based on four pillars where we believe there is both a need for action and where we can make a difference. The four pillars – Decarbonise, Accelerate, Collaborate and Embody – each address a different part of the low carbon transition, targeting the areas where investors have the biggest role to play.

Decarbonise our funds

- We aim to decarbonise our funds in line with the goals of the Paris Agreement. Each of our funds is covered by a 2025 and a 2035 climate target.

- We will integrate climate analysis into our investment process and conduct bespoke and targeted engagement to deliver against these targets.

Accelerate the transition

- We aim to increase the amount of capital being directed towards climate mitigation and adaptation solutions.

- We will grow our range of sustainable, thematic, and impact funds, and improve our data collection and monitoring of climate-related opportunity metrics.

Collaborate to drive change

- We aim to promote progressive climate action by collaborating with other investors.

- We will participate and lead collaborative investor initiatives to drive change at the corporate level and encourage policymakers to establish supportive regulatory environments.

Embody our standards

- We aim to hold ourselves to the same high standards we expect of investee companies.

- We will initiate and run internal initiatives to reduce our operational emissions, and foster partnerships with local charities to raise awareness and action.

Engaging on climate change

Our Climate Stewardship plan

As part of our Climate Strategy, we have developed a Climate Stewardship Plan, which contains the companies responsible for over 70% of EdenTree’s financed emissions. The Plan sets out 13 climate-related expectations and assesses the performance of the high-impact companies against them. Based on how a company performs, we identify areas for improvement and translate these into bespoke engagement objectives. We then enter into dialogue over a three-year period to drive meaningful change.

Our insights

Insights

Climate Stewardship Report 2024/25

We are delighted to share EdenTree’s third Climate Stewardship Report, a milestone that reflects our continued commitment to sustainable investing and our proactive approach to climate responsibility.

Climate Stewardship Report 2023/24

This report reflects the important role we have in helping to accelerate systemic change. Amid record-breaking heat, and diminishing political ambition, it was a year for climate-focused investors to stand firm.

Climate Stewardship Report 2022/23

We are delighted to launch EdenTree’s first Climate Stewardship Report. It highlights new ambitions, targets and actions all designed to escalate action on climate change as urgent.

EdenTree’s Climate Commitment: now is the time for like-minded investors to step up

In response to evolving policy and industry landscapes, EdenTree redeclares its support for net zero, and reaffirms the company’s commitment to the climate targets laid out in its Climate Change Strategy.