Impact investing

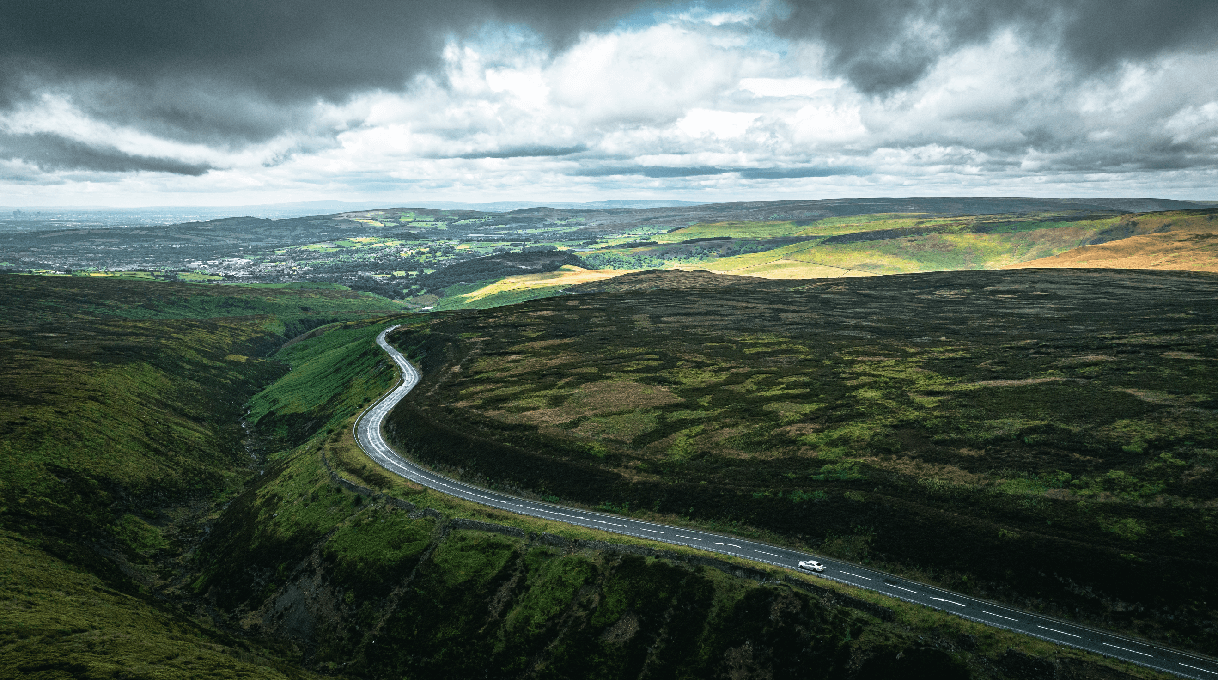

EdenTree has long had a pioneering spirit. Our business was built in the late 1980s upon ethical foundations that provided a platform for us to expand into sustainable investing over a decade ago, and we extended this commitment to impact investing with the launch of three Impact Funds in 2022. We are proud to have Sustainability Impact labels on funds across all three major asset classes: listed equities, fixed income and infrastructure.

Investing for impact

Our approach

Impact investing means investing in companies that aim to deliver meaningful social and environmental outcomes by addressing the world’s major societal and environmental challenges, while at the same time producing a financial return.

The value of an investment and the income from it may go down as well as up and the investor may not get back the amount invested.

How we do it

Intentionality-led approach

Impact investing, especially in public markets, is led by ‘intentionality’ – which sets an impact fund apart from a non-impact fund. This sets the purpose of the fund, steering its investments and our engagement activity towards its core Theory of Change. Our market-leading approach targets two levels of impact:

Asset contribution

The contribution provided by the underlying investments through their solutions to the problem identified within the Fund’s Theory of Change. This impact is captured in the Fund’s primary impact key performance indicator (KPI).

Investor contribution

Where we seek to create ‘additionality’, which is an increase in the assets’ activities beyond a business as usual scenario, by engaging with companies and encouraging an increase in the provision of solutions and a reduction in potential harms.

How we do it

Impact with integrity

Public market impact investing requires integrity and authenticity, in particular given challenges related to claims of causation, attribution and the impact measurement. We believe we have an important role in improving methods, influencing both underlying holdings and working with other practitioners to improve standards through groups such as the Impact Investing Initiative. The following principles inform our approach to public market impact investing:

Action with intention

Impact investing in public markets is inherently direct and active; the ability to divest when impact expectations are not met is as important as the ability to actively assess and participate in impact opportunities that come to market and, in some cases, seek to influence the pipeline of opportunities.

Additionality through stewardship

We believe combining asset allocation decisions with stewardship activities can drive enduring change, supporting real-world outcomes, innovation and market growth while limiting harms.

Collaborative and long-term

Impact investing requires patience and a collaborative, long-term approach to form constructive, influential relationships with underlying holdings; the low turnover of our funds typically reflects this. Collaborating with actors supporting similar goals strengthens the foundations of positive outcomes.

Finance-first approach

A finance-first approach to impact investing can attract a wider pool of potential investors, leading to long-term growth in capital available for positive real-world outcomes.

Discover our impact funds

The funds we mange are ‘finance-first’ impact investment vehicles. This means we seek to generate competitive returns while also generating a positive impact.

Our insights

Insights

Annual Impact Report 2024 – EdenTree Green Future Fund

Our Green Future Fund Impact Report for 2024 is now live. In this report, we discuss both the impact of the Fund’s holdings and the engagement activity we’ve taken over the year.

Annual Impact Report 2024 – EdenTree Green Infrastructure Fund

This report details the impact of the Fund’s underlying holdings and the engagement activity we’ve undertaken over the year. We believe combining asset allocation decisions with stewardship activities can drive enduring positive change and support real-world outcomes.

Scaling Solutions: The Fixed Income Opportunity in Plain Sight – EdenTree Global Impact Bond Fund

EdenTree’s Global Impact Bond Fund seeks to deliver competitive risk-adjusted returns while advancing impact principally through investment in GSS bonds—holding the philosophy that “labelled bonds issued by companies at the forefront of addressing social challenges are a fundamental way for investors to generate positive impact” in fixed income.

Annual Impact Report March 2024 – EdenTree Global Impact Bond Fund

This report details how the Fund has invested for positive outcomes and continued to meet both elements of its core objective as a financial-first impact vehicle in 2024.

Two EdenTree funds adopt SDR ‘Sustainability Impact’ label

EdenTree’s Green Future fund and Green Infrastructure fund met the requirements for the label