Chapter 3 Food & Farm Animal Welfare

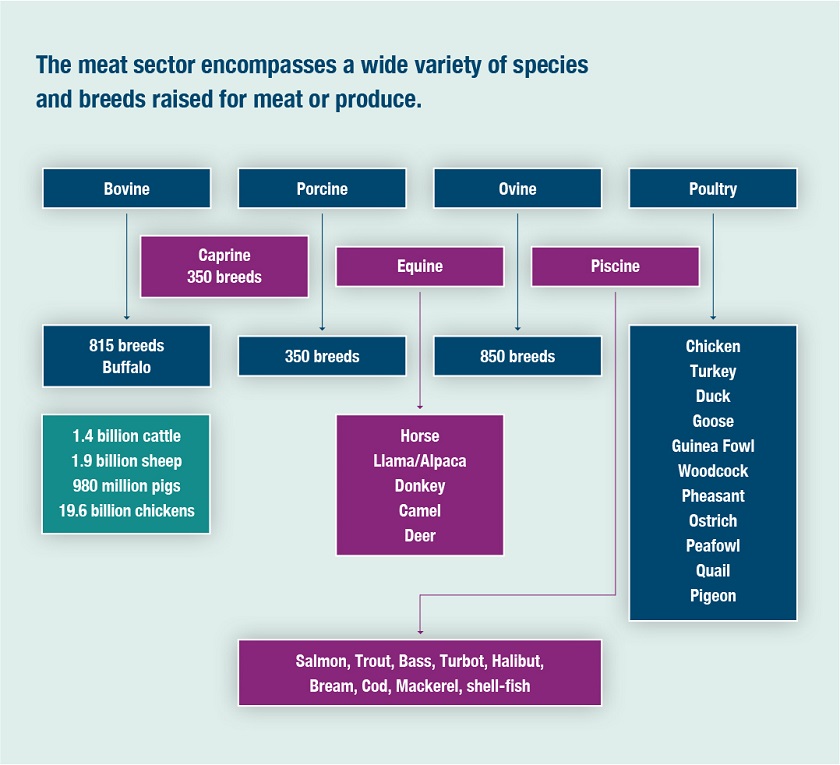

The global meat sector was valued at close to $1trillion in 2018, with around 330m tonnes produced. Pork and poultry together are the two most produced meat types by weight globally, with poultry the #1 type of produced meat across the world.

Macro demographics have fuelled meat production – urbanisation and the creation of a global middle-class has fuelled protein enriched diets involving more meat and less rice and fewer pulses and vegetables.

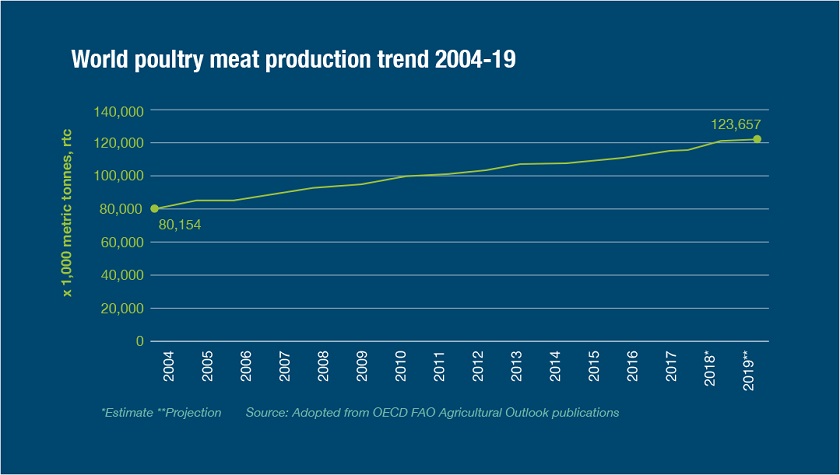

The EU28 headcount of reared livestock (bovine, sheep and goats) declined over the period 2010-18, although pig head count – fuelled by strong Chinese demand, boomed over the same period. Poultry based diets have seen the strongest growth manifested in the number of reared birds. The global industry produced nearly 125m tonnes of poultry meat in 2018 – in Europe alone production increased by 25% since 2010.

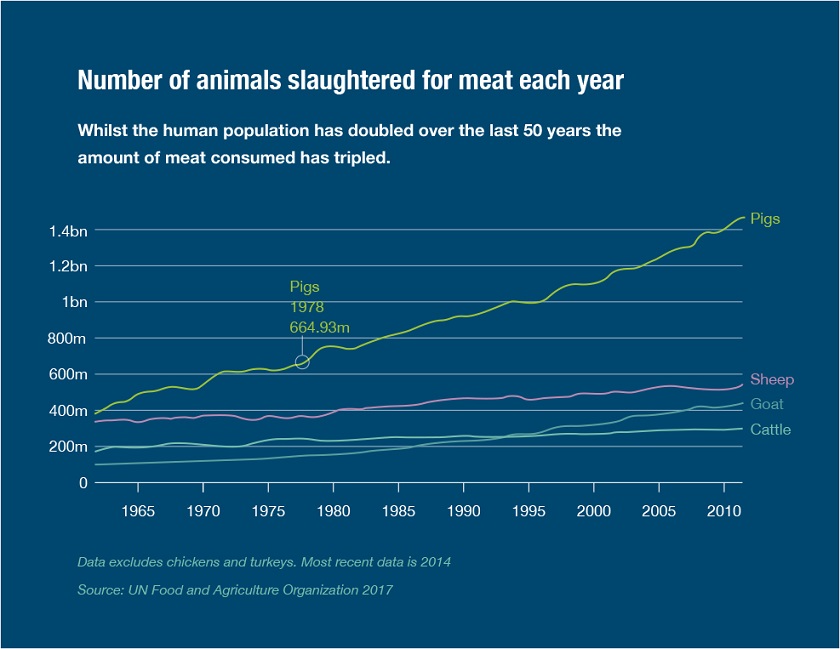

Animals reared for meat represents husbandry and slaughter on an industrial scale. According to the World Economic Forum, an estimated 50bn chickens are slaughtered annually for food not counting ‘disposable’ male chicks. The numbers of pigs, sheep and cattle are equally large at 1.5bn pigs, 500m sheep and around 200m cattle.

Most of the growing demand has come from developing and middle-income economies, whilst in the West, meat consumption appears to be in long-term decline. This is seen in the emergence of China – once an agrarian economy – as the primary source of growth in demand for meat.

Meat production is literally ‘costing the earth’. Meat, dairy and poultry now account for 75% of all agriculture-related GHG emissions (>9% of all global emissions). Land used for beef production has accelerated forest clearance and deforestation in particular, whilst 33% of the world’s grain production now supports animal feed, rather than human consumption. Beef production is also water intensive with c1kg of beef requiring over 15,000 litres of water to produce.

Implications for Welfare

At its simplest, modern intensive farming practices seek to maximise production via higher stocking density. Most forms of animal husbandry can be subject to intensive practices but milk, meat and eggs are the main outputs connected with intensive production.

Whilst this has allowed poorer populations to have access to protein as never before it has come at a cost – notably welfare and an increasing use of pharmacological intervention via the use of antibiotics. Even in the UK, intensive practices are becoming common as economies of scale place pressure on smaller enterprises. The Environment Agency in the UK has defined ‘intensive’ as places for 40,000 birds or 2,000 pigs and is most prevalent in the broiler, turkey and laying-hen poultry markets. There are now over 1,500 ‘intensive’ poultry farms in the UK and close to 800 ‘mega-farms’ with capacity for 125,000 broiler hens, 82,000 laying hens, 2,500 pigs or 700 head of dairy cattle.

None of these industrial scale enterprises are investible – all are privately owned. Outside Europe, this kind of scale is the norm: 99% of all US production is ‘intensive’. Clearly, whilst welfare need not be compromised, it often is. We identify the key welfare issues as:

- Lack of space and cramming in pens, crates or cages - inability to reflect natural behaviour

- Mutilation e.g. tail docking and beak clipping - it is believed over 90% of pigs tails are docked

- Growth stimulants to increase yield which typically leads to lameness, weak bones or fatality

- Overuse of antibiotics to counter health conditions brought on by environmental ones

- In the US 80% of all antibiotics are used in food production on farm animals

- Environmental degradation and animal ill health owing to poor control of slurry

Responding to Welfare: Supporting Business Benchmark on Farm Animal Welfare (BBFAW)

BBFAW is the leading measure for investors on farm animal welfare, and we are proud to have supported it since inception.

BBFAW is a global measure of policy commitment, performance and disclosure by food producers, processors and retailers, and over its eight years of benchmark reporting, has established itself as an authoritative voice on animal welfare – a subject seldom reported on by companies prior to the Benchmark’s launch. Coverage has increased from 68 global companies in 2012 to 150 in 2019. Progress has been strong – but also reveals how much there is still to do for this to be recognised as a material risk for companies in the sector:

Evolving improvement in reporting farm animal welfare

Of the 150 companies surveyed in 2019, the majority now show evidence of Board oversight, and have formal implementation procedures in place, and 80% have improved their ranking since 2012. Companies are ranked in Tiers from Leadership (I) to ‘little disclosure’ (V). In our investible universe, we are delighted that so many holdings are ranked in the upper Tiers – M&S (I) and all three major UK food retailers (Tesco, J Sainsbury and Wm Morrison) in Tier II.

What is EdenTree’s Approach?

We are proud supporters of two investor led animal welfare related organisations – BBFAW and FAIRR (Farm Animal Investment Risk and Return). Both are collaborative investor initiatives that seek to drive better business behaviour in the management of animal welfare risk.

EdenTree is signatory to the BBFAW Investor Statement with aggregate investor backing of $2.4 trillion. We participate in the BBFAW annual engagement initiative, and through FAIRR we support their program of work on reducing the use of antibiotics in the food chain. Intensive farming is an Ethics negative screen in our Amity Funds. The Policy was adopted in 2010 and aims to avoid investing in the worst practices of global, mechanised animal husbandry. Particular attention is focused on poultry, cattle, piggeries, and caged fish-farming.

Although the Policy does not extend to retail, we engage with companies exposed to animal welfare issues on their approaches to managing the risk. Companies operating in transport and logistics are required to have ‘best practice’ policies in place. The number of companies caught by the Policy is fairly small – North American mega-farms and Asian sea food and caged fish farming are the most prevalent – we believe this is an important signal to send that EdenTree places animal welfare at the heart of investment policy. The policy is available on request.