Investors are seeing Europe with fresh eyes. With the US equity landscape having grown more challenging, driven by tariff tensions, political unpredictability and concerns over stretched valuations, Europe offers a compelling alternative, with its deep-rooted focus on corporate governance and strong trade frameworks. But while the region presents undeniable strengths, it is also navigating its own turbulence.

In France, President Macron’s inability to secure a stable government has stalled much-needed fiscal reform. Contrastingly, Germany is preparing to unleash a €500 billion spend on infrastructure, a move that could reshape the country’s industrial base and boost long-term economic growth. Overlay this with the ongoing war in Ukraine and uncertainty around US tariffs, particularly Trump’s sector-specific threats to European industries like pharmaceuticals, it's clear that Europe faces challenges of its own.

But volatility presents opportunity for discerning investors, and it’s precisely in these moments that active management proves its worth. In volatile markets, passive strategies can miss the nuance – the mispriced risks, the overlooked opportunities and the companies steadily building long-term value.

To uncover quality companies trading below their intrinsic worth, active management – with conviction and discipline – is required. The EdenTree European Equity Fund employs this approach, investing in undervalued companies with strong fundamentals. The Fund’s management team considers investments on a stock-by-stock basis, applying rigorous analysis to assess quality, sustainability and long-term growth potential.

Why is now the right time to invest in value?

For value-focused managers, periods of economic or political instability can reveal investment prospects, especially when a company’s market price diverges from its intrinsic worth. Take the volatility in France as an example, where the lack of a stable government is severely shaking investor confidence. The seventh Prime Minister of Macron’s presidency, Sébastien Lecornu, resigned on the 6 October after less than one month in the role, causing the CAC 40 to sell off again1. In our view, France is becoming increasingly comparable to the Italy of old, with mounting concerns over its inability to control its public finances and numerous collapsing governments pushing the yield on France’s 10-year government bond yield higher. Indeed, the yield on French 10-year bonds rose above Italy’s in early October2.

Despite this, many French companies remain fundamentally sound. Importantly, a significant number of French companies are globally diversified, generating revenues beyond their domestic borders. With companies’ valuations being dragged down by association with France’s political unrest, this has created openings for selective, long-term investors. We used the ongoing uncertainty in France to add to some of our high-conviction names with international exposure, such as insurance company AXA, engineering company Mersen and advertising company Publicis.

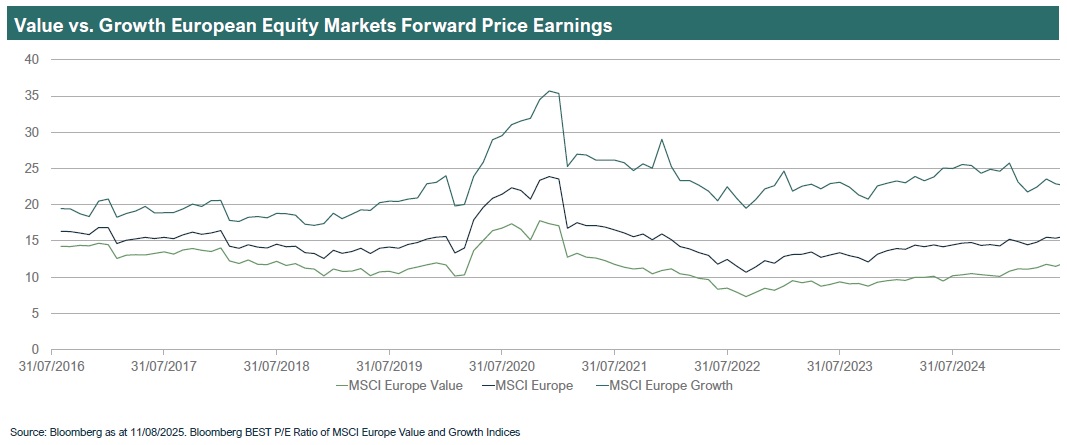

On a broader macro scale, while falling inflation and improving real household incomes may suggest a supportive backdrop for growth stocks, incoming fiscal spend across Europe could push interest rates higher – a tailwind for banks, which is still a strategic overweight in the portfolio. There is also the pricing dispersion between growth and value to consider, with value still trading at a discount to growth by historical standards.

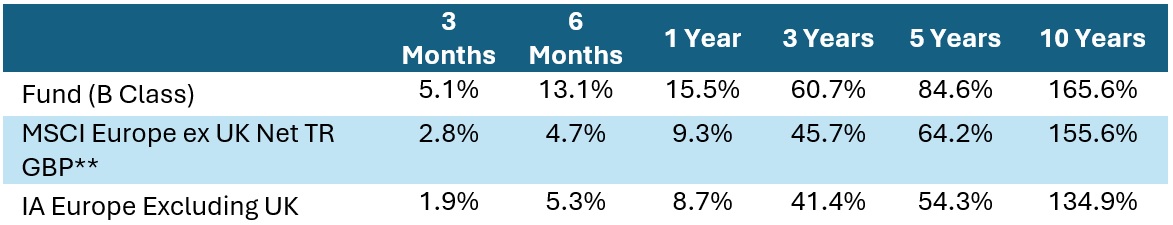

Finally, the Fund’s performance deserves attention. Over one, three, five and ten years, the EdenTree European Equity Fund has provided top quartile performance in the IA Europe excluding UK sector. It has also outperformed its benchmark, the MSCI Europe excluding the UK, across these time frames; see performance tables below.* This consistent long-term performance highlights the potential benefits of a value-led approach. Compared to growth strategies, value strategies can offer more stable returns over time, as they typically focus on companies with the potential to generate reliable future cash flows for shareholders rather than relying on momentum, which can introduce greater volatility. This is why the EdenTree European Equity Fund maintains a value focus, striving to build a resilient portfolio capable of navigating uncertain market conditions.

Opportunity hides in plain sight, and we know how to find it

Value investing is rooted in company fundamentals – in assessing future cash flows, balance sheet strength and margin resilience. In a market currently shaped by shifting sentiments, The EdenTree European Equity Fund’s active approach continues to find companies using disciplined, stock-by-stock analysis. Sometimes, this is re-investing in companies we have previously held. This includes names like Merck KGaA, the healthcare and life sciences company, which the Fund exited due to its high valuation but has since re-entered following a meaningful pullback.

Small and mid-cap (SMID) cyclicals are a key area of focus for the Fund’s management team. Recent additions to holdings such as Technotrans, the technology and service group specialising in cooling, temperature control and filtration systems, and Indus Holding, a German firm supporting the growth of medium-sized industrial and tech businesses, reflect the team’s positioning ahead of anticipated fiscal investment in Germany. While the Fund does not invest directly in defence due to its sustainability criteria, the broader industrial infrastructure required to support such spending – factories, cables and cooling systems, for example – could benefit significantly. These areas remain underappreciated by the market, revealing investment prospects that align with the Fund’s value-focused approach.

Sopra Steria, a recent addition to the Fund, is another SMID that aligns with the broader theme of anticipated fiscal expenditure. Cyber-security is one area expected to benefit, with defence-related investments accounting for 1.5% of NATO’s 5% defence spending target3. Sopra Steria’s expertise in cyber-security positions it well to gain from adjacent infrastructure spending. At the time of purchase, the company was trading at an attractive valuation, with this potential not yet fully priced in by the market.

Finally, we are continuing to monitor cyclical SMID opportunities in challenged sectors, as the dislocation between current market pricing and these companies’ intrinsic value could present an interesting entry point when the cycle turns.

Life insurance companies are also standing out as worthy of consideration. While they have not outperformed to the degree of other insurance sectors, the higher interest rate environment continues to support their performance. Also, across Europe, pension fund buyouts are becoming more common as corporates looks to de-risk their balance sheets by transferring defined benefit pension liabilities to third parties. Life insurers are well-placed to manage these liabilities effectively, thanks to their long-term investment horizons and capital structure.

Whether revisiting former holdings like Merck after valuation resets, identifying underappreciated SMIDs poised to benefit from Germany’s fiscal stimulus or exploring sectors like life insurance where structural shifts are underway, the team remains focused on uncovering real value.

Is Europe ready to rebound?

Of course, a degree of caution remains warranted. Equity markets have rebounded strongly since the initial shock of Trump’s tariff announcements. However, the full economic impact of these measures is still unfolding. As we move into the fourth quarter, further volatility in Europe is possible. However, for contrarian, value-focused investors, such periods of uncertainty can create fertile ground for long-term opportunities.

That being said, Europe is beginning to show signs of renewed strength. With substantial fiscal investment on the horizon and growing recognition of the strength and resilience of European companies4, the region is beginning to reassert itself as a compelling destination for long-term capital.

The EdenTree European Equity Fund is well-positioned to capture this potential, with a disciplined value approach that seeks to uncover underappreciated, sustainable businesses poised to benefit from structural shifts. In a market grappling with uncertainty, we believe this strategy offers a resilient and forward-looking way to invest in Europe’s next chapter.

*Performance

Data as at 31.08.2025

Source: Morningstar. Figures compared on a Bid to Bid basis with Net Income reinvested. Past performance is not necessarily a guide to future returns.

Data as at 31.08.2025

Source: Morningstar. Figures compared on a Bid to Bid basis with Net Income reinvested. Past performance is not necessarily a guide to future returns.

**The MSCI Europe ex UK GBP Net Total Return Index was adopted as the Fund’s comparative benchmark on 1 January 2024, replacing the FTSE World Europe ex UK Index. As the Fund invests in a diverse range of European (ex UK) companies and sectors we compare the Fund’s performance to the MSCI Europe ex UK GBP Net Total Return Index, however the portfolio manager is not bound or influenced by the index when making investment decisions.

This document has been prepared by EdenTree Investment Management Limited for Financial Advisors, other intermediaries and other investment professionals only. It is not suitable for private individuals. This document has been produced for information purposes only and as such the views contained herein are not to be taken as advice or recommendation to buy or sell any investment or interest thereto. Please note that the value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations, you may not get back the amount originally invested. Past performance is not necessarily a guide to future returns . Selecting stocks due to our ethical criteria means that the choice of stocks is limited to a subset of the stock market, and this could lead to increased volatility.

A full explanation of the characteristics of the investments is given in the Key Investor Information Document (KIID). Any forecast, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, EdenTree Investment Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all-inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecast made will come to pass . This financial promotion issued by EdenTree Investment Management Limited (EdenTree) Reg No. 2519319. Registered in England at Benefact House, 2000, Pioneer Avenue, Gloucester Business Park, Brockworth, Gloucester, GL3 4AW, United Kingdom. EdenTree is authorised and regulated by the Financial Conduct Authority and is a member of the Investment Association. Firm Reference Number 527473

Sources

- France’s new prime minister resigns after less than a month in the job | The Independent

- French borrowing costs top Italy’s as Lecornu’s resignation forces risk rethink | POLITICO

- NATO agrees to 5% higher defence spending target ahead key summit at The Hague | Euronews

- European business has shown surprising resilience