Three weeks ago, Spain and Portugal suffered a power blackout reported to be the worst in European history. As trains halted, traffic lights went dark and internet connections failed, the Iberian Peninsula’s populace was plunged into disarray.

After power was restored, the Spanish government was quick to demand answers, pointing the finger firmly towards the grid, which in turn blamed electricity generators. It wasn’t long before climate change deniers blamed renewable energy, determining the cause of the blackout as the large share of wind and solar power in the grid at the time of the outage.

While it’s easy to accuse renewables, outdated grid infrastructure should take the lion’s share of the blame. As a fund manager of a green infrastructure fund, I believe the blackout exposed a future necessity – increased investment in the grid and in the utility-scale battery storage systems needed to support it. This could provide potential growth opportunities for the companies facilitating these changes.

So, what did cause the blackout?

Currently, the cause of the blackout is still being determined. What is clear is that a drop in Spain’s grid load at around 12:30 pm on Monday 28 April destabilised electricity flows, resulting in the grid’s frequency falling below 50hz.1 This meant power safety mechanisms stopped the flow of electricity, as supply and demand must be precisely matched at 50hz to maintain grid stability.

The US Department of Energy’s secretary was among those that pinned the blame on renewable energy.2 Indeed, Spain and Portugal were sourcing over half of their electricity from solar and wind when the blackout occurred.3, 4 But, this is not unusual. In fact, renewables accounted for around 56% of Spain’s electricity mix on average during 2024.5

Critics also argued that the inability of renewable energy sources to produce ‘inertia’, the kinetic energy caused by the rotation of spinning turbines, meant there was no backup power to mitigate the sudden drop in the grid load.6 In fossil-fuelled power stations, energy produced by the rotation of turbines acts as a flywheel, continuing to deliver energy if generation drops off the grid. Renewables, however, cannot provide this energy in the same way.

Then how can power outages be prevented in the future?

Although the lack of inertia in the grid may have played its part, wind and solar power can generate synthetic inertia fully equivalent to rotational inertia. Southern Australia’s grid system works with over 80% solar and wind supply due to big batteries that support the grid and suppress power fluctuations quickly.7 Arguably, then, if Spain’s grid was backed up by more batteries, the blackout may have been prevented.

Then, we come to the question of the grid itself. Spain has underinvested in its grid for several years. However, Spain’s renewable energy sector has grown significantly.8 According to the IEA, spending on new solar capacity reached $500 billion last year while investment in the grid was around $400 billion. This relative underspend means grids are finding it difficult to keep up with the requirements of the renewable energy being supplied.9 At the time of the blackout, renewables were providing energy cheaply and abundantly to the grid, at €6/MWh compared with a more common range of €50/MWh to €100/MWh. This begs the question, if Spain’s grid had been updated over the last fifty years to withstand excess supply, would the blackout have happened at all?

What are the blackout’s implications for green infrastructure investment?

Although the blackout may have given ammunition to critics of renewables, I don’t expect it will halt the motion of Spain and Portugal towards a cleaner, greener electricity system. I’m hopeful the blackout will result in greater understanding among governments and regulators regarding the importance of investing in the grid. This may, in turn, affect investment in companies like National Grid (currently held in the portfolio) and the Spanish grid operator Redeia.

If the blackout does act as a wake-up call for governments, it may also lead to greater understanding of the importance of building out utility-scale battery energy storage, which can support intermittent generation in modern grids. This could affect companies such as Gore Street Energy Storage (also currently held).

Using crisis as a compass

While the exact cause of the blackout remains unclear, a more up-to-date grid and greater deployment of battery storage systems would have been more likely to cope with the power fluctuations. The blackout, therefore, underscores the need to invest in resilient, future-fit energy systems.

The EdenTree Green Infrastructure Fund has performed strongly in the second quarter of 2025 so far. With Trump’s tariffs leading to concerns about a stagflationary global trade war, we believe investors are again turning to infrastructure as a potential safe haven investment due to economically insensitive business models and inflation-linked revenues. In our view, sustainable infrastructure is again being viewed as a third asset class, offering a strategic hedge against volatility in an uncertain macroeconomic backdrop.

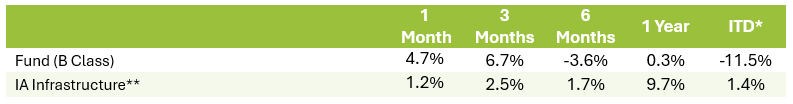

Performance

Source: Morningstar. Figures compared on a Bid to Bid basis with Net Income Reinvested.

*Inception Date: 28 September 2022

Data as at 30.04.2024

Data as at 30.04.2024

Source: Morningstar. Figures compared on a Bid to Bid basis with Net Income Reinvested. Past performance is not necessarily a guide to future returns.

**As the Fund will invest in companies involved in the ownership, operation or maintenance of infrastructure assets, investors may compare the Fund’s performance to the Investment Association Infrastructure Sector. Funds in this sector must have at least 80% of their assets (directly or indirectly) in companies involved in the ownership, operation or maintenance of infrastructure assets (including but not limited to: utilities, energy, transport, health, education, security and communications). However, the Manager is not bound or influenced by the Sector category when making investment decisions.

This document has been prepared by EdenTree Investment Management Limited for Financial Advisors, other intermediaries and other investment professionals only. It is not suitable for private individuals. This document has been produced for information purposes only and as such the views contained herein are not to be taken as advice or recommendation to buy or sell any investment or interest thereto. Please note that the value of an investment and the income from it can fall as well as rise as a result of market and currency fluctuations, you may not get back the amount originally invested. Past performance is not necessarily a guide to future returns.

A full explanation of the characteristics of the investments is given in the Key Investor Information Document (KIID). Any forecast, figures, opinions, statements of financial market trends or investment techniques and strategies expressed are, unless otherwise stated, EdenTree Investment Management’s own at the date of this document. They are considered to be reliable at the time of writing, may not necessarily be all-inclusive and are not guaranteed as to accuracy. There is no guarantee that any forecast made will come to pass.

Sources

- Don’t blame renewables for Spain’s power outage | Reuters

- Trump’s Energy Secretary Baselessly Blames Spain’s Power Outage on Renewables | Scientific American

- What caused the blackout in Spain and Portugal and did renewable energy play a part? | Renewable energy | The Guardian

- Don’t blame renewables for Spain’s power outage | Reuters

- Renewable energies generated 56% of Spain's electricity mix in 2024 | Red Eléctrica

- Grid Inertia Becomes Political Following Spain's Power Outage

- Spain doubles its renewable capacity amidst grid limitations | Aurora Energy Research

- Don’t blame renewables for Spain’s power outage | Reuters