Chris Hiorns, Head of European Equities writes that the current market and economic backdrop presents a rare opportunity for value orientated European investors.

1) Better Value

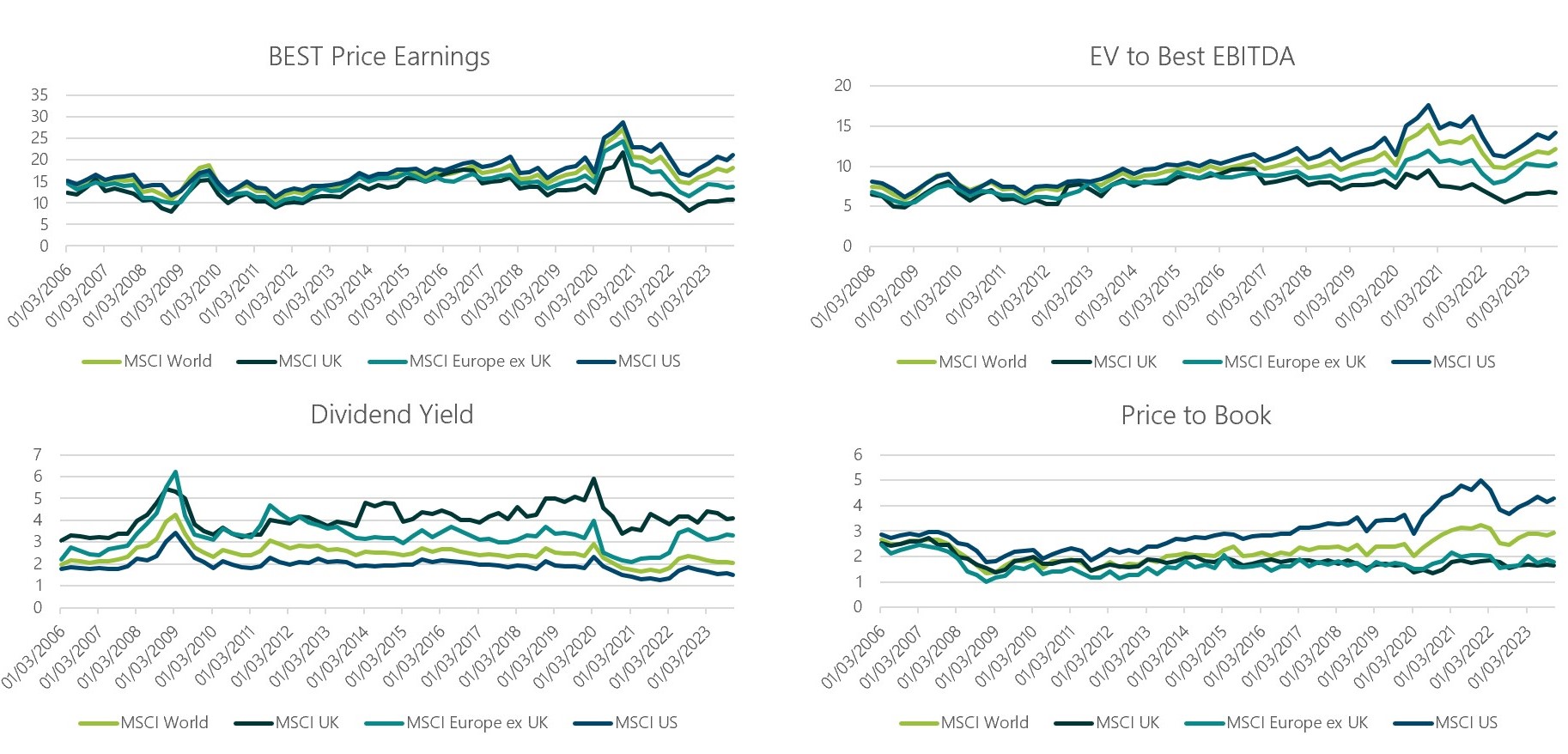

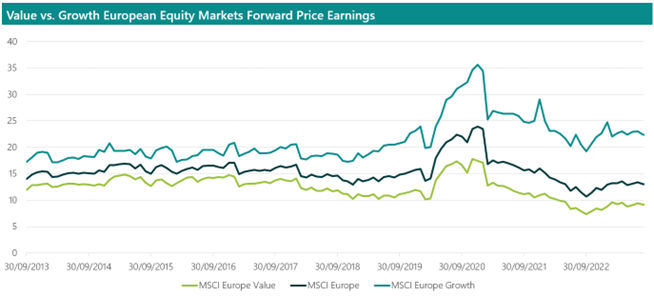

The US has experienced a 10-year bull market and the valuation of the market has reached excessively high levels. This is not solely due to the rapid growth of the so-called magnificent seven – Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla. Indeed, compared to Europe all sectors in the US have seen a relative increase in value over the last decade, save for Healthcare and Energy. European bourses, on the other hand, have not been subject to the same extreme momentum-driven rally and valuations in the US are close to record high levels relative to those on offer in Europe (Figure 1). At the same time, we are also seeing a historically high dispersion between growth and value in European markets (Figure 2).

This presents an opportunity for active, value-oriented managers to seek companies trading at historic discounts, including several with hidden growth potential. Examples include Smurfit Kappa and Billerud, paper-based packaging companies that have benefitted from increased demand from both ecommerce and from the increasing substitution of more environmentally friendly biodegradable or recyclable packaging materials for disposable plastics. The undervaluation of European equities is even more significant when you move down in terms of market cap with companies like Mersen, which is exposed to strong structural growth trends, such as electrification, renewable energy, electric vehicles, semiconductors wafers and railways, trading at under 10 times earnings.

Figure 1: Europe is more attractively valued on a range of metrics (Source: Bloomberg 21/11/23)

Figure 2: Value is as a large discount to growth

Source: Bloomberg as at 04/09/2023. Bloomberg BEST P/E Ratio of MSCI Europe Value and Growth Indices

2) Better Banks, Stronger Consumers, Rate Sensitivity

There is little doubt that the global economy is facing headwinds. However, we are of the view the US economy is looking increasingly frail. The US consumer appears far more stretched having run down post-Covid cash surpluses to support spending, while European households behaved more conservatively. This comes out clearly in household savings data where the US rate has dipped to 3.4%, which is below the longer-term average of roughly 5% prior to Covid, while in the EU the savings rate is north of 14% which is above longer term averages (which are typically higher than the US). US regional banks with their weak balance sheets have also proven more vulnerable to rising interest rates than European banks which had continued to de-lever and are now financially much stronger. We believe there is particular value to be found in banks with strong retail franchises – the likes of Santander, BBVA and Bank of Ireland – which are benefitting from higher interest rates and resilient consumer trends.

Finally, The US equity market is also far more exposed to information technology, venture capital and private equity, all areas which may struggle with the ‘higher for longer’ narrative set by the Fed. Accordingly, we see this as an opportunity for fund selectors to de-risk from being overly exposed to high valuations and fragile economic conditions in the US and reinvest in a more stable European economy at far more reasonable valuations.

3) Diversification

The growth of US tech giants has meant the sector dominates the domestic and, indeed, global indices. However, in Europe there a great dispersion of potential opportunities across sectors, which increases scope for portfolio diversification. For example, we see opportunities in sectors such as Financials where many companies are still trading at a steep discount to book values despite improved operating conditions in a higher interest rate and bond yield environment. Industrials and Materials are also compelling. Although they have suffered in the short term from high levels of destocking in the supply chain, they should bounce back as this process moves to an end. Meanwhile, telecoms is a sector trading on an excessively low valuation. It is expected to become increasingly cash generative as the peak in capex for the industry relating to the roll-out of 5G and fibre has now passed.

Finally, Europe is home to many of the world’s leading sustainable companies with EU a leader in implementing environmental and social regulations, providing an excellent way for investors to access long term structural growth trends such as the development of the green grid, renewable energy, and electric vehicles, as well as many associated underlying technologies, materials and equipment to decarbonise the economy.

At the same time there has been an ESG backlash in the US, which has dampened the appetite for sustainable investing there. However, one must tread with caution not to get caught up in ESG growth bubbles in Europe which have ultimately burst. We are contrarian investors, which means we have avoided the hype around stocks such as Vestas, Ørsted and Sartorius seen in recent years. Instead, we apply a rigorous bottom-up stocking picking process, focussing on finding companies at the right valuation relative to their fundamentals and avoiding both potential value traps and excessive valuations in highly speculative market episodes.

Opportunity set

We believe there are global and regional headwinds that need to be considered when making asset allocation decisions and selecting funds. In particular, we believe a cautious stance is warranted towards the US given record high valuations and economic frailties associated with banks, consumer debt and Fed policy. Europe is now an attractive proposition with an opportunity to access some of the world’s best multinational and domestic companies at record low valuations. Investing in the region could also improve portfolio diversification and access to leading sustainable companies across multiple sectors. There are undoubtedly market and idiosyncratic risks which is why selecting a highly skilled value-oriented portfolio manager will be the key to unlocking Europe’s compelling opportunity set.

About the R&S EdenTree European Equity Fund

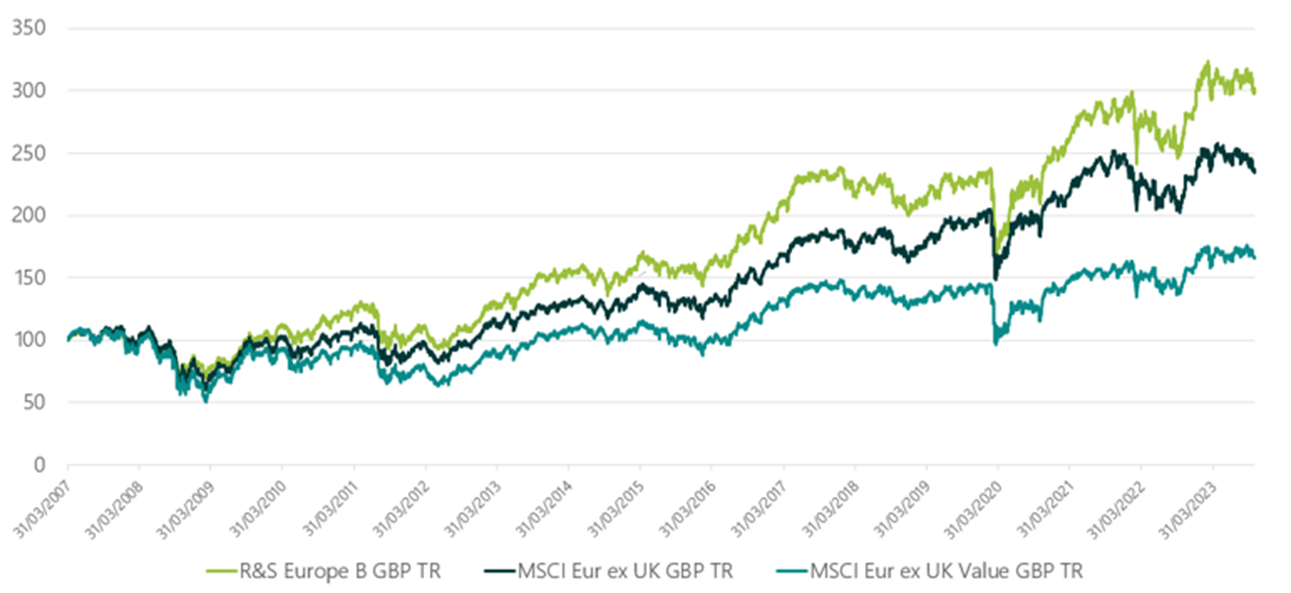

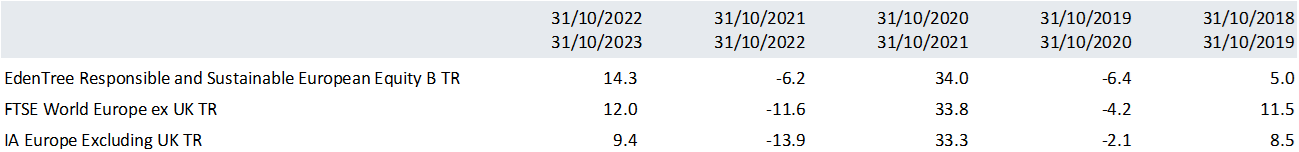

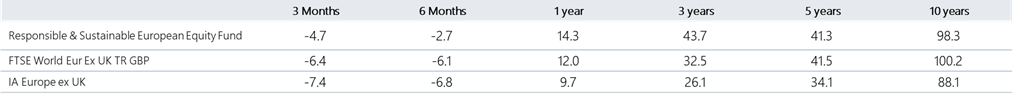

Chris Hiorns has been lead manager on the fund for over 15 years. His philosophy is value-orientated and contrarian, with a focus on income generation. Over his tenure, Chris has applied the same thorough bottom-up process of seeking attractive valuation relative to fundamentals. The outcome is a diversified portfolio of responsible and sustainable companies, which in aggregate trade at a significant discount relative to the benchmark and which has historically generated a strong yield. In the time Chris has managed the fund, he has outperformed the IA sector and benchmark despite stylistic headwinds (Figure 3 and 4). However, given the backdrop addressed in this memo we are most excited about the prospects for the fund, and believe it is well placed to benefit from a stylistic tailwind as value regains the market’s favour.

For further information please reach out to your representative at EdenTree: Contact Us | EdenTree (edentreeim.com)

The value of any investment, and the income generated from it may fall as well as rise and will be affected by currently fluctuating changes in interest rates, general market conditions and other political, social and economic developments, as well as by specific matters relating to the assets in which it invests.

Figure 3: R&S European Fund has outperformed despite stylistic headwinds

Source: Bloomberg

Figure 4: R&S European Fund discrete and cumulative performance

Source: FE Analytics, bid to bid with net income reinvested, as at 31/10/2023

Source: Morningstar, bid to bid with net income reinvested, as at 31/10/2023

Past performance is not necessarily a guide to future returns.

The views contained herein are not to be taken as advice or recommendation to buy or sell any investment or interest. The value of an investment and the income from it can fall as well as rise, you may not get back the amount originally invested. Past performance should not be seen as a guide to future performance. EdenTree is authorised and regulated by the Financial Conduct Authority and is a member of the Investment Association. Firm Reference Number 527473.