As responsible, sustainable, and thematic investors, engagement with companies is one of the most important aspects of our work, and one which can result in real-world impacts.

In the past three decades of engaging with companies in our portfolios, it has proved a good way of improving investee companies’ performance on a range of environmental, social and governance topics.

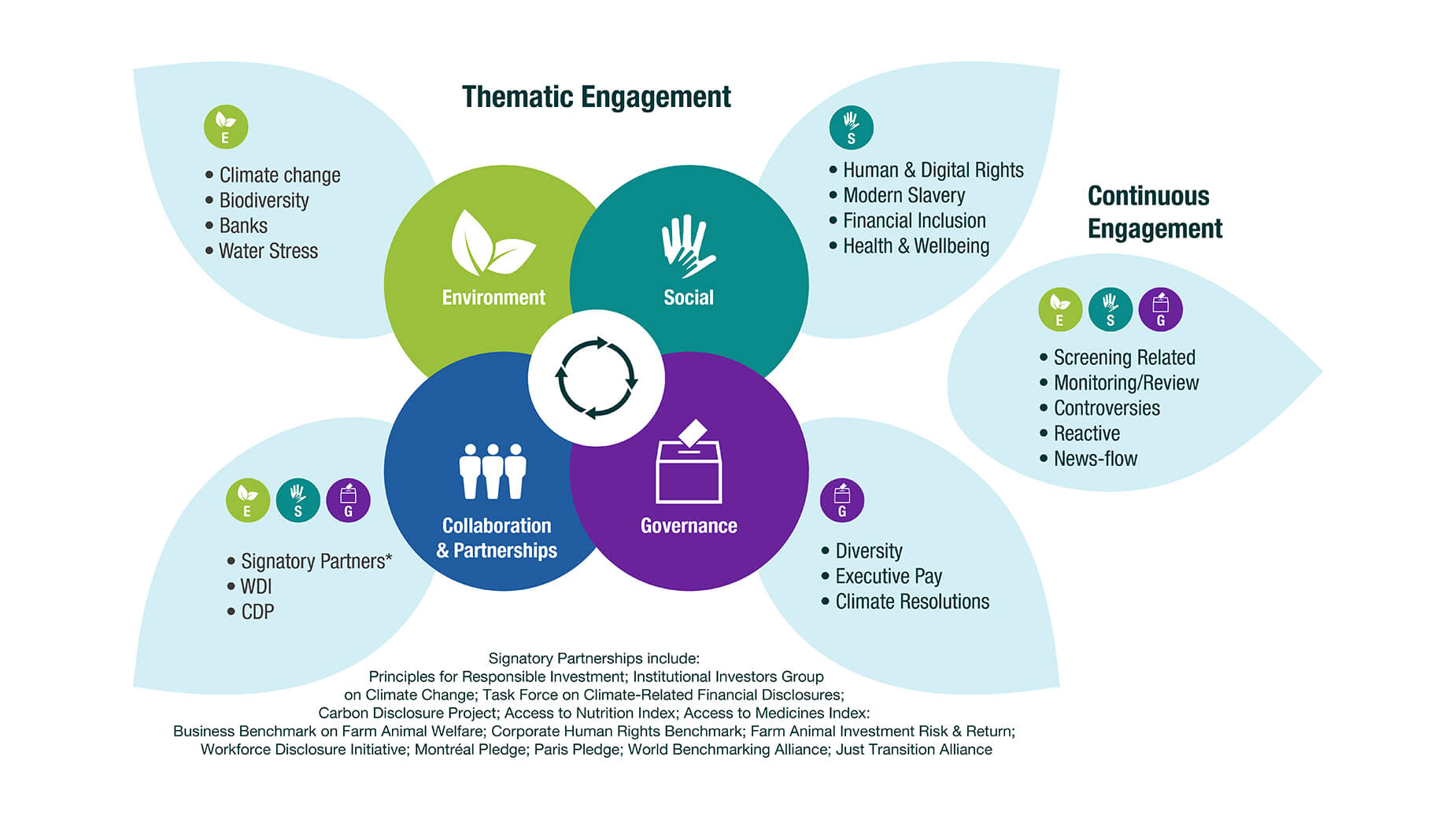

Every year, the EdenTree Responsible Investment Team chooses new engagement themes to focus on for the year ahead. These are conducted alongside our ongoing engagement with companies following screenings, reviews and news-flow. Our engagement priorities for 2023 are shown below:

Environment

Climate Change has been a core thematic engagement for many years, and our focus is on encouraging companies to set Science Based Targets (SBTs). SBTs provide a clearly defined path to reduce emissions in line with what the latest climate science deems necessary, ensuring alignment of decarbonisation efforts with the goals of the Paris Agreement. In 2023 we will be building on this work by developing a ‘Climate Stewardship Plan’. This will target companies responsible for the majority of EdenTree’s financed emissions and will track their performance against a series of decarbonisation objectives.

As with last year, our focus on climate change extends to Banks. As a house which does not invest in oil and gas, our highest exposure to fossil fuels is a result of the banking sectors financing. This topic has been part of our thematic engagement for four consecutive years and we will continue to engage with banks, both unilaterally and collaboratively as members of the Institutional Investors Group on Climate Change (IIGCC), to encourage withdrawal from projects that fail to align with the Paris Agreement goals.

We are cognisant that the E in ESG reaches well beyond climate change and with this in mind we have two further topics of focus for 2023: Biodiversity and Water Stress.Biodiversity has been an engagement focus since 2020, back when very few companies had a biodiversity policy in place and only a handful considered the topic to be a material risk to the business. Today, it has risen up the corporate agenda and through an engagement with our food and agriculture holdings we will encourage the sector to press ahead with ambitious action. Lastly, the UN predicts that for every 1°C of warming there will be a 20% drop in renewable water resources.1 Water stress is a global challenge and with this in mind, we are seeking to conduct a baseline ‘water footprint’ assessment across high-impact sectors in 2023, and engage with these firms to understand their impacts and encourage better water management.

Social

Respect for Human Rights – both in company direct operations and across their supply chains – is a core pillar of our social engagement. This year we are continuing our focus on modern slavery, an issue which affects an estimated 50 million people globally.2 We will be leading engagements with a number of our construction holdings as part of the ‘Find it, Fix it, Prevent it’ collaborative engagement, encouraging companies to find and report on instances of modern slavery.

Despite their positive environmental impact, renewable energy projects face significant human rights challenges. For instance, it is estimated that wind and onshore solar projects require about 10 times more land than fossil fuel projects to deliver the same power, placing significant pressure on local communities and indigenous populations globally.3 With this in mind, we will be engaging with our renewable energy infrastructure holdings to ensure they have a robust approach to respect for human rights.

Increasingly there are also human rights risks associated with new technology such as artificial intelligence, including privacy, misinformation, and discrimination concerns. Given the growing nature of these risks, will engage with our technology holdings to ensure the development and deployment of these technologies in a rights respecting way.

Obesity continues to impact the developed economy significantly, with 28% of adults in England obese and a further 36% overweight.4 Health and Wellbeing therefore is a key focus, and we are engaging with our food and supermarkets holdings, as part the Access to Nutrition Index and ShareAction Healthy Markets Initiative, on how they are tackling these challenges. Our work on health and wellbeing extends to access to medicine, and in particular we will engage via the Access To Medicine Foundation to close the healthcare equity gap.

Lastly under the social banner, we are planning to conduct an engagement with our holdings across the financial services sector on the topic of Financial Inclusion. An estimated one in four adults experience financial exclusion at least once in their lives, many being denied access to credit and other basic services.5 Financial inclusion remains unresolved and is, in our view, a pressing ESG issue. One issue we hope to explore is the impact on financial inclusion from bank branch closures in the UK which have nearly halved since 2015.

Governance

EdenTree supports the targets of the Hampton-Alexander Review and Parker Review, and as with previous years Diversity will continue to be a focus of our engagement activity in 2023. Where Boards lack gender or ethnic diversity in line with these goals, we will engage both unilaterally and collaboratively as members of the 30% Club Investor Group to understand the steps they are taking to rectify this.

We have long engaged on Executive Remuneration, and executive pay accounts for the majority of voting action taken. We have a detailed framework on executive pay, and find it very challenging to support pay packages in the FTSE100 where we view the majority to be excessive. Where we vote against remuneration, we also seek to engage with the Board to encourage changes.

Lastly, as with last year we expect a growing number of company climate resolutions at the 2023 AGM season, as well as a rise in “Say on Climate” votes on AGM agendas. We will consider each proposal on its merits, with a view to supporting where these are informed, detailed and clearly set out intermediate milestones and targets.

Collaborations & Partnerships

Collaborative engagements are key to wider progress on environmental, social, and governance issues, by leveraging the collective voice and expertise of like-minded investors and other stakeholders to drive change. As with previous years, we will work with a number of organisations to further the impact of our engagement activity such as the IIGCC and the PRI. Among other collaborative initiatives, we will continue to push for better corporate disclosure on ESG issues through our annual participation in the CDP Non-Disclosure Campaign and the Workforce Disclosure Initiative.

For updates on our engagement work throughout the year, look out for our quarterly RI Activity Reports on our website!

Source

- https://news.un.org/en/story/2022/05/1118722

- https://www.un.org/en/delegate/50-million-people-modern-slavery-un-report

- https://www.brookings.edu/research/renewables-land-use-and-local-opposition-in-the-united-states/

- https://commonslibrary.parliament.uk/research-briefings/sn03336/

- https://www.fca.org.uk/news/speeches/keeping-pace-rising-costs-improving-financial-inclusion-consumers