Executive pay continues to attract criticism and has long been a contentious issue for investors, in the media and wider society. In this updated RI Expert Briefing we take a deep dive into executive pay, how it works, how it is calculated, and what our

approach to it is.

HOW ARE COMPANY EXECUTIVES NORMALLY REWARDED?

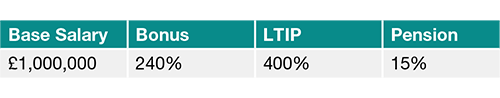

In the UK, executive directors are normally rewarded via a package of short and long-term incentives that are designed to pay out in the event of the company achieving certain strategic targets. In the main, an executive might hope to receive a base salary,

a short-term annual bonus and share awards under one or more long-term incentive plans (sometimes abbreviated as LTIPs or PSPs). Executives also accrue a pension pot and are often contractually entitled to company benefits. Incentives are most often

expressed as a percentage of base salary. A typical pay profile of a mid-tier FTSE100 Chief Executive is set out below:

Therefore, subject to performance the Chief Executive above may potentially earn up to 640% base salary, with a further 15% in pension contributions. On average, base salary only makes up around 20% of the total executive package, with the largest portions

contributed by short-term bonus (25%) and long-term awards (51%). Pension and benefits make up 6%1.

WHAT DOES VARIABLE PAY ENTAIL?

Best practice has until recently mandated that all variable pay is performance tested prior to pay out. In the main short-term annual bonus is linked to one-year personal and corporate objectives. Long-term awards measure company performance over a period

of three years. Different performance tests should ideally be applied to each scheme to avoid what is known as ‘double dipping’ or directors being paid twice for the same performance. ESG measures have become increasingly popular with

86% of FTSE100 companies applying some kind of environmental or social performance in 2022 compared to 64% in 2021. These include carbon reduction, health & safety or diversity performance targets2.

WHAT DOES A TYPICAL LONG-TERM INCENTIVE PLAN LOOK LIKE?

Companies may employ a range of schemes, but these fall into two groups: an award of ‘free shares’ (often known as Performance Share Plans (PSP) or Long-Term Incentive Plans (LTIP)), or Share Options, a financial instrument providing the opportunity,

but not the obligation, to buy at a price set by the Remuneration Committee at a discount to the market price.

Typically, these schemes, which require shareholder approval to implement, operate over a ten-year period, with annual grants measured over

three years. If performance has been met after that time, the shares are said to “vest”: if not they lapse or are granted in part. With Option schemes, the performance period is again three years, and the executive has up to a further

seven years to exercise the option. If after three years performance has been met, the shares vest: if not they lapse. However, if at the time of vesting the option to buy price is more than the market price they are said to be “under water”

and have no value. Following pressure from investors the vesting period is increasingly set at three years with a further two-year holding period, making a five year ‘pay cycle’ in total. Option schemes have become increasingly rare in

the UK owing to the difficulty in assessing their value.

WHAT ARE RESTRICTED SHARE PLANS?

COVID-19 led to a degree of ‘pay havoc’ as companies sought to preserve cash and recalibrate their strategy. Executives in many cases typically took a base salary cut of 20% for three to six months. Setting reliable longer term performance

targets, particularly those linked to EPS (earnings per share), became fraught given there was no visibility on future earnings. One response has been to abandon LTIPs in favour of Restricted Share Plans (RSPs). Burberry was among the first to put

such a plan to shareholders in 2020, and in response to that being broadly accepted, many more such as BT and Lloyds Banking Group have followed. RSPs typically halve the maximum grant but in return have no or limited performance tests attached. For

instance, the Burberry RSP with a maximum grant of 162.5% of salary replaced an LTIP that had double that maximum of 325%2. The market has ‘settled’ on these plans having a 50% discount as being ‘best practice’.

HOW IS PERFORMANCE MEASURED?

Companies are expected to adopt performance hurdles that are appropriate to the business, are stretching and align with shareholder interests. The most usual metrics employed are a combination of Total Shareholder Return (measured against a comparable

peer group or index) or EPS (earnings per share).

Companies may also choose additional or alternative hurdles such as return on capital employed (ROCE), free cash flow, sustainability or ESG indicators or Net Asset Value (relevant to real estate).

The Remuneration Committee is responsible for setting the policy criteria and monitoring delivery. It is considered best practice for each scheme to employ at least two or more performance hurdles.

IS IT EASY FOR SHAREHOLDERS TO ASSESS VALUE?

No. A frequent criticism of contemporary executive pay is its complexity and lack of transparency; most schemes demand a level of technical expertise that excludes the majority, whilst the performance conditions attached are not easy to interpret in terms

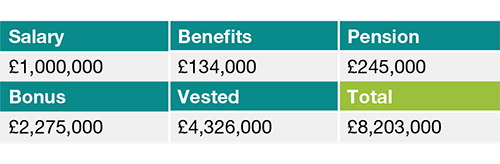

of their direct link to growing and sustaining long-term shareholder value. Quite often we see schemes pay out when performance does not appear to warrant it! Recent reforms have required companies to set out a ‘single figure’ of pay received

in the year; but this is not necessarily the same as the amount awarded given ‘grants’ of shares will be tested over three-years to assess the actual pay-out. The example below shows a typical ‘single figure’ that was paid

(table) for a FTSE100 Chief Executive.

However, under the approved Remuneration Policy, the CEO could potentially earn 900% of base salary (400% bonus + 500% in LTIP grant) or £9,000,000 in addition to base salary, pension and benefits. Bonus is normally based on the actual one-year

performance whilst the grant of shares is awarded at maximum – and then performance tested after three years.

HAS THIS OPAQUENESS CONTRIBUTED TO EXCESSIVE PAY?

The opaque nature of long-term incentives has, in our view, contributed to the ratcheting of pay over-time. The median pay for Chief Executives among the FTSE100 is now 119 times higher than the average full-time employee; this equates to an average package

of £4.1m3. The mean pay ratio between the CEO and their employees is now 110.1 times4. We believe strongly in fair and appropriate levels of pay, however it is hard to justify the very significant levels of executive pay

that now dominate across many sectors.

ARE THERE SOME VERY SIGNIFICANT OUTLIERS?

Yes. Despite intense scrutiny, some companies continue to pay very excessive levels of variable pay, often owing to the poor design of the incentive scheme. In 2019, ten FTSE100 companies paid their CEO in excess of £8m, and four more than £10m5.

By way of example the Chief Executives of Astra-Zeneca, Royal Dutch Shell and GSK earned £14.3m, £8.76m and £8.36m respectively. In 2021 pay rebounded strongly after being constrained during the pandemic; average bonus was 82% of

maximum opportunity in 2021 compared to 44% the year before.

HOW ARE SHAREHOLDERS ABLE TO VOTE ON PAY?

Since 2006 companies in the UK have been required to hold an annual advisory vote on executive pay. This follows publication of the Remuneration Report as part of the Annual Report cycle. The Remuneration Report is backward looking and reviews what has

been paid.

Since 2014 following reforms introduced by the Coalition Government, companies are required to put a binding vote to shareholders on Remuneration Policy. The vote has to be held at least every three years and seeks approval of the various elements of

pay and any increases to the individual elements, such as bonus. Any change to Policy between the triennial vote needs additional shareholder approval. This applies to all companies listed on the premium market, but not to AIM.

In theory these reforms, as well as empowering shareholders, were designed to constrict the escalation of pay on an annual basis. Most companies first sought a binding vote on Policy in 2014, which means 2017, 2020 and 2023 are ‘Policy’ years

for a large number of UK companies.

If a Remuneration Report is voted down in a non-policy year, the company is required to return with a new vote on Policy. The failure of a Remuneration Policy vote requires a company to either maintain the old Policy or return at a General Meeting seeking

approval for a new revised Policy.

Share incentive plans, which last for 10 years, are subject to different rules requiring a binding vote on the plan’s expiry in order to commence a new one.

HOW OFTEN DO INVESTORS OPPOSE REMUNERATION?

Where there has been opposition in the UK, the trend has been for significant votes against the annual advisory vote rather than against Policy. Voting down the latter remains rare, suggesting the intention to empower shareholders has not really occurred.

The Investment Association maintains a public register of ‘significant votes’ which is taken to mean opposition in excess of 20%. In 2021 just one UK Remuneration Policy was voted down, and a further seven attracted over 30% opposition.

In the same year, the advisory vote on the Remuneration Report saw three voted down, and a further 29 having more than 30% oppose6.

WHAT ABOUT OVERSEAS?

Each territory applies different rules and putting executive pay to a shareholder vote is not required in many jurisdictions. The US Say on Pay regime allows shareholders to vote on the frequency of a vote, and at an advisory level on pay itself. In some

parts of Europe, remuneration policy or director fees are put to vote, but there is no EU wide requirement as such. For instance, in Germany, shareholders are usually able to vote on Supervisory Board fees, but not on executive pay, whereas in France

there is often a specific vote to approve CEO pay but not wider Board members. In Asia, voting on pay is rare, and is not generally accepted in Japan. Even in mature Asian markets such as Singapore, shareholders may only be asked to vote on the level

of aggregate fees, rather than the individual elements.

WHAT DOES EDENTREE LOOK FOR IN DECIDING HOW TO VOTE?

Our published Corporate Governance Policy sets out in detail what we look for in deciding how to vote. In essence we take the view that remuneration should be sufficient to recruit, retain and motivate without being excessive, and should not reward undue

risk. Overall, in assessing each pay proposal we look for the quality of disclosure so as to allow an informed view, whether performance hurdles appear stretching and the potential for excess. In general terms, annual and long-term awards that exceed

300% salary per annum will trigger an ‘excess assessment’. This does not mean we would automatically support pay awards up to 300% salary, but that additional scrutiny is applied in these cases.

Factors that contribute towards opposing

remuneration include below market consensus performance criteria; criteria linked wholly to share price appreciation; factors generally outside of a director’s control (such as commodity price movements); and long-term incentive schemes that

are tiered towards, and reward excessively for, median or threshold performance.

In circumstances where we view the structure of pay to be particularly egregious, we often oppose the Chairman (or members) of the Remuneration Committee; we expect all

companies to exercise ‘malus’ and ‘clawback’ in the event of material issues arising that should make awards forfeit.

ARE THERE ANY OTHER CONTENTIOUS ELEMENTS OF PAY?

Most directors are entitled to corporate benefits such as a car, health insurance etc. We ensure these appear reasonable in aggregate and may oppose where they are not.

Pension payments have attracted recent attention, with a concerted move to bring these

in line with the wider workforce. Pensions are most often paid as a cash amount expressed as a percentage of salary and typically could be as much as 30-35% of base salary for a typical executive. The Investment Association (IA) issued guidance that

these should be in line with employees and not used to ratchet remuneration.

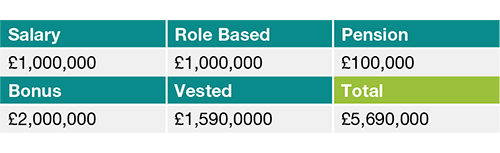

The Banks introduced a device to circumvent EU rules on pay introduced following the financial crash. This limited variable pay to 100% of salary, or 200% with shareholder

approval. The UK banks in response effectively doubled salary; in most cases this has been called ‘role-based pay’. Variable pay is then calculated against the increased base salary and role-based pay. We have always taken the view that

we will not support role-based pay and have long opposed remuneration as a result.

A typical Bank pay package is shown below:

HOW MUCH ACTION DOES EIM TAKE OVERALL IN VOTING?

The majority of resolutions put to shareholders are routine and non-contentious; that is why the level of opposition is relatively small. In 2021 we opposed/abstained 7% of resolutions in the UK and 12% overseas. This hides the fact that we opposed 51%

of all UK remuneration ballots in 2021, and 91% of all FTSE100 remuneration ballots that we own. Remuneration was 48% of all UK action taken, followed by Board directors (30%)7.

THE RESPONSIBLE INVESTMENT TEAM

We have a specialist in-house Responsible Investment (RI) team who carry out thematic and stock-specific research to identify ethically responsible investment ideas for our range of screened Funds. Headed up by Neville White, Head of RI Policy & Research,

and supported by Responsible Investment Analysts Carlota Esguevillas, Rita Wyshelesky and Amelia Gaston, the team is also responsible for creating an on-going dialogue with companies, allowing us to engage on a wide variety of ethical and socially

responsible investment concerns. For investors, it’s an added layer of assurance that our client’s money is being invested in companies that are operating in a responsible and sustainable way. Our ethical and responsible investment process

is overseen by an independent Advisory Panel that meets three times a year, and comprises industry and business experts, appointed for their specialist knowledge.

SOURCES

- www.cipd.co.uk 2019 Pay Review

- PwC Executive Pay at FTSE100 firms Executive pay at FTSE 100 firms back to pre-pandemic levels, PwC analysis shows

- Burberry Remuneration Report and AGM Notice www.burberry.com

- PwC ibid

- www.cipd.co.uk 2019 Pay Review

- www.cipd.co.uk 2019 Pay Review

- EdenTree Investment Management Ltd