Our robust screening process means that only truly responsible and sustainable companies make their way into the portfolios. In this Expert Briefing we highlight two UK companies held in our portfolios, that have strong environmental, social and governance credentials.

SSE is a UK energy company active in the generation, transmission and distribution of electricity as well as a range of other energy related services. It has undergone some changes recently, having sold its retail business and now seeking to focus on the development and operations of assets that are “vital to the low carbon transition”.

SSE remains a well-run business in a highly regulated industry which has delivered excellent long-term total returns for investors. The defensive business model has held up well during the COVID-19 pandemic and has benefitted from the decision by management to focus on developing a leadership position in renewable energy. The shares have delivered returns in excess of 500%, nearly 5 times more than the FTSE All-Share over 20 years on a total return basis (to June 2020). The ability of the non-cyclical business model to keep delivering inflation linked dividends regardless of the macro and geo-political environment remains a key attraction for long-term investors.

What were the last full year results like?

For 2019/20, the company reported an adjusted

EBITDA of £2.2 billion, up from £1.7 billion the previous year, in part due to

the strong performance of the renewables division which represented 49.7% of

the total adjusted operating profit.

Adjusted profit before tax amounted to £1,023m up from £685m the previous year. During 2019/20 the company continued to maintain strong network reliability and its transmission business achieved a 99.99% reliability rate, although it aims for 100%.

Is there a dividend??

For 2020 the Board has recommended a full year dividend of 80p, this is slightly below the dividend paid the two previous years, however this is still in line with its five year dividend plan set out in 2018, despite the current economic conditions. For 2020/21, 2021/22 and 2022/23, the company is "targeting annual increases in the full-year dividend that at least keep pace with RPI inflation”.

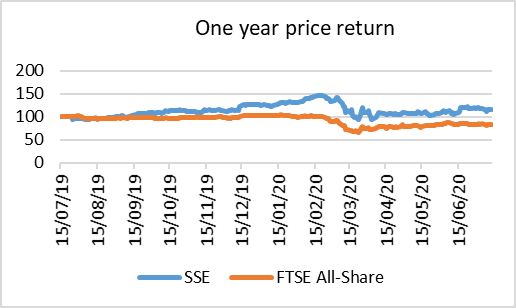

Has the Stock performed well?

Yes. The company has performed well, with three year total return amounting to 17.2% vs -4.6% for the FTSE All Share.

What is the responsible investment case?

SSE is a company that understands what it means to be a responsible and sustainable company, showing strong awareness of all key ESG issues that are relevant for its activities as an electric utility business.

Its environmental practices are good with a range of indicators including water consumption, carbon emissions and NOx all showing a reducing trend. It also publishes a detailed report on biodiversity explaining how its operations seek at all times to protect and restore biodiversity, whilst supporting healthier ecosystems.

reduction in its total recordable injury rate. SSE is also an accredited Living Wage employer in the UK.

Finally SSE shows best practice in the area of corporate governance, good Board independence as well as 30% female Directors. It makes a clear statement not to use tax havens and has achieved the UK Fair Tax mark – a certification that recognises organisations that pay the right amount of corporation tax at the right time and in the right place. SSE is also one of only a handful of FTSE100 companies where EdenTree has felt able to support the remuneration policy.

What stands out particularly?

SSE aims to support the low carbon transition and has set out some ambitious targets to deliver this. It is the company’s ambition to halve the carbon intensity of the electricity it generates, to develop and build enough renewable energy capacity to treble renewable output and help accommodate 10 million electric vehicles on Britain’s electricity networks. In addition it reports in a transparent way on all things climate related with a commitment to be fully compliant with the TCFD (Task Force on Climate-related Financial Disclosures’) recommendations by March 2021.

Severn Trent

What do they do?

Severn Trent is a FTSE100 company active in the water sector. It provides clean water and waste water services to households and businesses, supplying them with 2 billion litres of drinking water each day and treating 2.9 billion litres of waste water.

Who does Severn Trent serve?

As its name indicates, the company serves customers in the catchment areas of the rivers Severn and Trent. Headquartered in Coventry, Severn Trent provides services to more than 4.5 million households and businesses in the Midlands and Wales.

What is the investment case?

In the listed equity space, there are only three

water companies available in the UK. Severn Trent has a long track record of

delivering reliable earnings coupled with long-term asset growth. The company

operates in a region which is forecast to have the largest population and

household growth

outside London by 2040. The shares have delivered returns in excess of 800%, nearly 7 times more than the FTSE All-Share over 20 years on a total return basis (to June 2020). The ability of the non-cyclical business model to keep delivering inflation linked dividends regardless of the macro and geo-political environment remains a key attraction for long-term investors.

What were the last full year results like?

In 2019, the company achieved a Group turnover of £1,844 million, up £76 million from the previous year and reported a profit before interest and tax of £551.5 million. Severn Trent also reported continued improvements in key customer measures with year-on-year reductions in leakage (4%), supply interruptions (61%), and water quality complaints (14%). In 2019 the number of complaints related to drinking water quality reduced from 11,856 to 10,181 whilst the same year the number of pollution incidents reduced by 12% from 328 to 288.

Is there a dividend?

Severn Trent has a strong history of paying dividends and these have increased continuously over the last decade. From 65p per share back in 2010, it paid 100p per share in 2019/20. The company expects the dividend to increase further in the coming year.

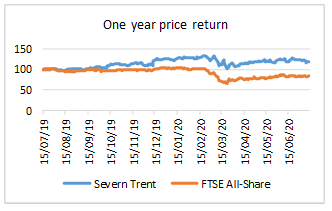

Has the Stock performed well?

Yes. The company has performed well, with three year total return amounting to 29.7% vs -4.6% in the FTSE All Share.

What is the responsible investment case?

At a recent visit to the company’s headquarters in Coventry we were particularly impressed by Severn Trent’s commitment to being a company with a social purpose.

From a social perspective, it is obvious that the company places strong emphasis on customer service and affordability; accessibility of water is key. It has various schemes to help 69,000 customers who struggle to pay their bills and aims to increase this to 195,000 customers by the end of 2025. OfWat (the sector’s regulator) continues to rate Severn Trent as the best water company for affordability.

The company has many interesting initiatives to help customers reduce their consumption. Water scarcity is a reality in some of the areas in which it operates, therefore there’s a strong focus on saving water through customer education as well as leak detection, and plans to roll out over 500,000 metres in water stressed areas.

The company relies on nature to provide clean water and so it is in the company’s best interest to preserve nature too. Severn Trent has several ambitious goals. These include enhancing the biodiversity of 5,000 hectares of land (1% of the national target) by 2027; halve the number of pollution incidents in its region over the next five years; and improve the quality of a further third of the region’s rivers, equating to 2,100km.

Severn Trent also has a strong commitment to tackle climate change. Its triple carbon pledge means that the company wants to be carbon neutral, use 100% electric vehicles and use 100% renewable energy. It already generates 54% of its own electricity. This is one of the ways the company aims to achieve its triple carbon pledge together with the use of anaerobic digestion, flexibility in its energy use as well as technology innovation.

Via its Green Power business of anaerobic digesters and composters, Severn Trent works with 50 local authorities across the country on sustainable organic waste management from which it generates green electricity.

What stands out particularly?

With a female CEO and female Chair, a balanced board and Executive Committee and good gender diversity across the organization, Severn Trent rates 3rd in the Hampton Alexander review. We’ve long engaged with companies in the UK on this topic and Severn Trent is a great example that shows what’s possible.

Sources

SSE 2020 Annual Report & 2020 Sustainability Report

Severn Trent 2020 Annual report & Sustainability report

Bloomberg (15.07.2020)